Net Dollar Retention Is The Gold Standard Of Customer Success Measurement

Few metrics yield as much insight and impact on a company’s valuation as Net Dollar Retention (NDR). Factoring upgrades, downgrades and churn, NDR gives a clear picture of how much growth a company is able to generate from existing customers and, by extension, how satisfied those customers are with the value being delivered. In the exploding subscription-based economy, it’s no surprise that SaaS leaders are honing in and focusing on this metric as a key indicator of overall health and valuation.

Given its importance, are you optimizing each element of the NDR formula and empowering your team to drive market-leading Net Dollar Retention?

Below, we examine the various constituents that make up Net Dollar Retention and how to effectively measure your team on the leading indicators that drive best-in-class NDR.

Understanding Net Dollar Retention

Net Dollar Retention can be calculated using the following formula:

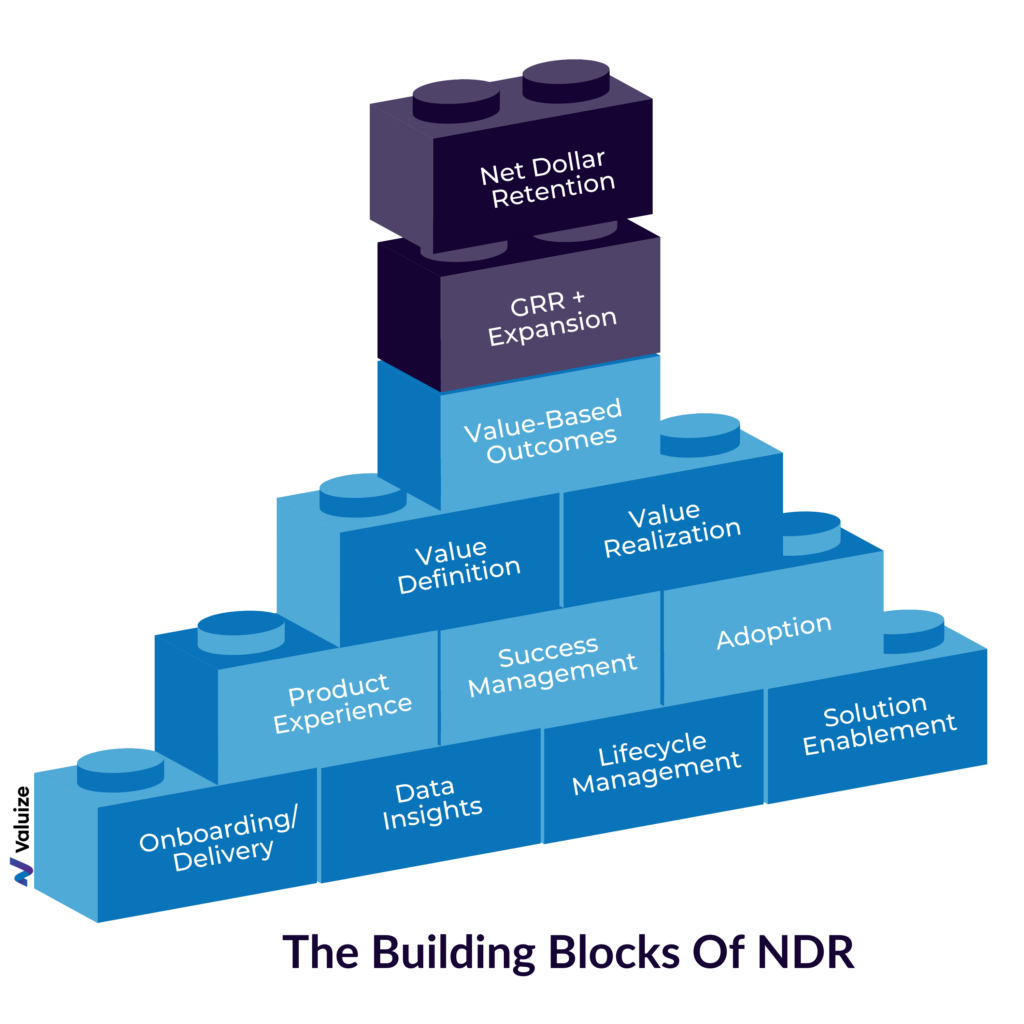

While there are many elements to the NDR formula, they are all rooted in Value-Based Outcomes. Your ability to deliver and execute on outcomes alone impacts two-thirds of the NDR equation. As you turn your attention to Net Dollar Retention, it’s critical to break down this metric, understand all the key factors and actions that contribute to it (as displayed in the diagram) and ensure your organization is aligned on every element and their role within it.

Key Drivers of Net Dollar Retention

The 3 main components of NDR are: expansion, downgrades and churn. Here’s how your Customer Success team can optimize each element for maximum impact:

1. Churn

By definition, churn is when a customer either leaves your platform entirely or stops using a specific feature, product or service.

- Customer Success Impact: CSMs’ understanding of the product’s features and how users intended to engage with those features to solve a business problem is essential. Often, churn occurs because a customer subscribed to a specific feature or capability but was never able to implement it or it did not meet their business needs.

- Recommendation: Make sure you are enabling your customers on product features and capabilities and showing them how they align to their use cases and outcomes. Leverage telemetry to evaluate product usage and to determine if certain features are not being used at all. If detected, schedule a Use Case Workshop to create momentum and generate ideas around driving customer value with those features.

2. Downgrades

We define downgrades as a decrease in usage of the platform. If a cohort of end users stop using your platform and/or the amount of usage decreases over a period of time, it results in the customer reducing their contractual revenue.

- Customer Success Impact: Keeping your customers engaged and using your solution is the key to preventing downgrades. Oftentimes, senior stakeholders purchase solutions to meet a business need but forget to translate that need and value down to the end users. It’s these end users that ultimately drive and determine usage. It’s also where usage stalls if they do not understand the value of your solution and how it will make their jobs easier.

- Recommendation: Focus on enabling your end users on your solution and communicating how it will simplify their jobs. Create user groups, lunch-and-learns and other user events to keep your customers engaged and sharing ideas about your products to drive usage and value. Additionally, it’s important to continuously track usage patterns and trends and have proper playbooks to address stuck or stalled situations when they arise with customers.

3. Expansion

We saved expansion for last; as you can imagine, expansion is positive and shows growth in your customer base. Many times, expansion is attributed to the Sales organization, and rightfully so. Given this situation, how can Customer Success assist?

- Customer Success Impact: Expansion can only occur when the customer sees value in the products and services they’ve already purchased, solves meaningful business outcomes and feels that they have a trusted partner. The combination of these three factors results in them wanting to extend your solutions to other use cases.

- Recommendation: Ensure you are showing value realization and delivering on value messaging during QBRs. Also, “showing up” and becoming a trusted advisor to your customers will result in your customers sharing new use cases and problems that need solving – leading to expansion opportunities.

Should You Be Measuring Your Customer Success Organization On NDR?

At this point, there should be no shadow of a doubt that NDR is one of the most important success metrics to your recurring revenue organization. But does that mean your Customer Success organization should be solely measured on NDR?

Over the years, there have been a lot of conversations on how to properly measure Customer Success organizations. It may seem straightforward to measure CS on NDR, but I would contend that CSMs should NOT be measured solely on NDR. This is because NDR is a lagging indicator, meaning by the time you measure the impacts of NDR, it’s too late to do anything about it. Rather than measure your CSMs on NDR, think about measuring them on the leading indicators that drive NDR; such as preventing churn and downgrades, and promoting growth and expansion.

At Valuize, we recommend using the following leading indicators of NDR to best measure your Customer Success organization:

- Product & Features Adoption ━ Is your customer using specific products and features that indicate successful adoption and value? How are you measuring your product & feature usage?

- User Adoption ━ Are users in your platform regularly exercising features that show value and provide the right adoption motion? Do you know when certain users stop using your product?

- Time to Value & Time to Next Value ━ There is a strong correlation between TTV and Gross Retention Rate, but I would contend that Time to Next Value (and continuous value) is more critical to driving NDR. I see a lot of companies get to the initial value but then stall or get stuck. Measuring the frequency of new value achieved is a strong leading indicator of NDR.

- Value and Outcome Verification ━ When was the last time you verified value achievement with your customer? When was the last time you had a success story created and delivered to your customer?

- Customer Engagement ━ Are your customers happy? Are they showing up to meetings and engaging with your content? What about your other key stakeholders and executives? Do you have a proper Customer Engagement score and are you tracking how your customers are showing up?

- CS Sentiment (i.e. Gut Feel) ━ I’m a big fan of the CS Sentiment score (gut feel) because CSMs should have a pulse on their customers. Are you tracking and acting on it properly?

- New Use Cases ━ When was the last time your customer called you up and asked you to help them solve another problem? When was the last time your CSM updated the Customer Success Plan with new use cases and value-based outcomes?

Champion NDR As Your Organization’s Most Important Success Metric

The direct actions and activities of your Customer Success organization impact NDR more than any other team in your company. Given the criticality of this metric and its leading role in determining your company’s overall health and valuation, it’s imperative that you align your CS organization around NDR.

A strong Net Dollar Retention is rooted in your ability to successfully prescribe and deliver customer value. Read our article to learn how you can champion an organization-wide value-centric culture that drives value at every stage of the customer lifecycle.